You could be eligible for:

$0 Deductibles

$0 Doctor Visits

$0 Preventative Care

$0 Prescriptions

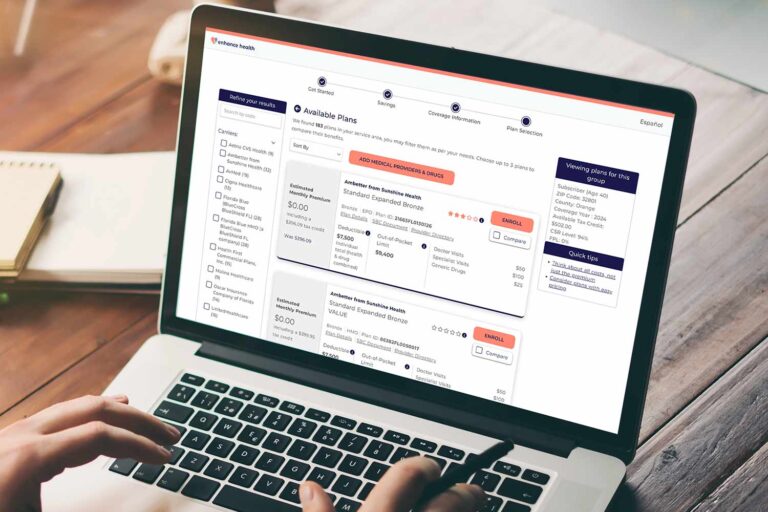

In just a few clicks, discover how much you can save every month on health insurance for you and your family.

Use our intuitive platform allows to easily compare a range of healthcare plans and find the perfect coverage for your needs.

Our team of licensed agents are ready and waiting to answer your questions, guide you through the enrollment process, and efficiently manage your ideal plan.

The Affordable Care Act (ACA) subsidy is a federal financial assistance program that helps lower monthly premiums and out-of-pocket costs for health insurance, ensuring access to affordable and comprehensive healthcare coverage.

Health insurance is expensive and can be hard to afford for people, so the government passed the Affordable Care Act to provide subsidies that lower premiums and out-of-pocket costs for eligible individuals.

The subsidy is for Americans making less than $55,000 annually and not on Medicare or Medicaid.

Your subsidy amount depends on your income. Individuals who qualify can receive more than $500/mo. in subsidies, and families of 4 or more can receive up to $1,600/mo. in subsidies. The best way to find out how much you qualify for is to call an agent now—83% of enrollees qualify for a subsidy, and 97% pay $0 monthly for their healthcare premium!

In less than 15 minutes, our agents can enroll you in the plan that best fits your needs.

No. You will receive a FREE no-obligation quote if our licensed agents determine you qualify for the subsidy.

Enhancehealth.com is a non-government website that is owned and operated by Enhance Operating LLC, which is an affiliate of Enhance Health LLC and Enhance IFP LLC. Both are licensed health insurance agencies and each does business as Enhance Health. Enhance Health is not affiliated with or endorsed by the U.S. government, Healthcare.gov. The purpose of this site is the solicitation of insurance. Contact may be made by an insurance agent/producer or insurance company.

Not all products are available in all states. Enhance Health represents various insurance carriers, dental plans, vision plans, Hospital Gap coverage plans and Prescription Drug Plans (PDP).

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Not all plans offer all of these benefits. Benefits may vary by carrier and location. Limitations and exclusions may apply.

By using this site, you acknowledge that you have read and agree to our Privacy Policy, Do Not Call Policy, Terms of Use and SMS Terms & Conditions.

© 2025 Enhance Health LLC. All Rights Reserved.